Home loan lending capacity

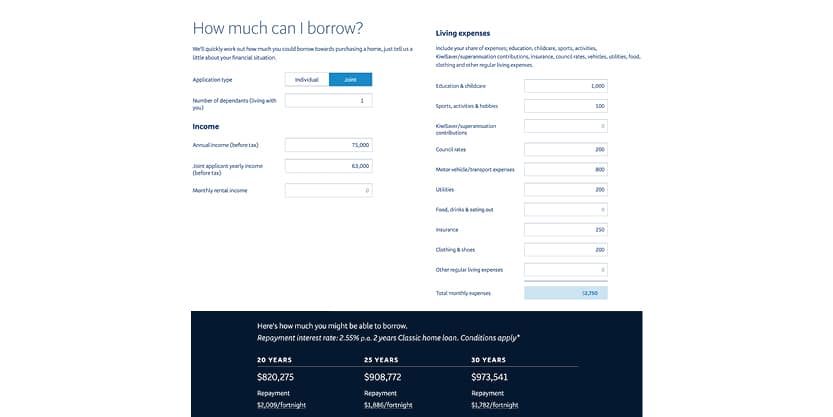

Just 10 days after announcing it would shutter its wholesale lending business loanDepot told federal regulators it plans to reduce its funding capacity. Estimate how much you can borrow for your home loan using our borrowing power calculator.

Guide To Your Home And Mortgage In Divorce 2022

The calculators max loan amount is NOK 15 000 000.

. Weekly and fortnightly repayment calculations. APPLY FOR LOAN APPLY FOR LOAN. For a conventional loan your DTI ration cannot exceed 36.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. In a filing with the. How is Home Loan eligibility calculated.

Compare home buying options today. Home Loan Calculator- Our easy to understand Home Loan EMI Calculator helps you calculate the EMI required to pay for your dream home. Provide a report for your mortgage capacity.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. Gross income - tax - living expenses - existing commitments - new. Divide that cash flow.

The borrowing capacity formula. For 2022 the FHA floor was set at 420680 for single-family home loans. Capacity Lending LLC NMLS 1389331 is a residential mortgage company licensed in the state of Texas.

View your borrowing capacity and estimated home loan repayments. We specialise solely in mortgage capacity reports. What is your maximum mortgage loan amount.

Suppose for example that you were comparing. To use HDFC EMI calculator Visit Now. Primarily this is required in a divorce scenario to.

The first step in buying a property is knowing the price range within your means. Provide a report on capacity for your ex. This maximum mortgage calculator collects these important variables.

Home loan rates for new loans are set based on the initial LVR and dont change because of changes to the LVR during the life of the loan. Housing loan eligibility is primarily dependent on the income and repayment capacity of the individualsThere are other factors that determine the. A formula for you to use to quickly determine if the property cash flows is.

Your borrowing capacity determines how much the. 1402 S Custer Road Suite 503 McKinney TX 75072. That largely depends on income and current monthly debt payments.

The mortgage calculator will take this information and display a graph detailing the amount of interest you will pay to each potential lender. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

To increase your mortgage amount consider improving your credit score cutting other loan debts and speaking to a mortgage broker. Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your. Lenders generally follow a basic formula to calculate your borrowing capacity.

The Future Of Ai In Mortgage Capacity

How Much Can I Borrow Home Loan Calculator

Lvr Borrowing Capacity Calculator Interest Co Nz

The 5 C S Of Credit What Lenders Look For

How Much Can I Borrow Home Loan Calculator

Borrowing Capacity Explained Your Mortgage

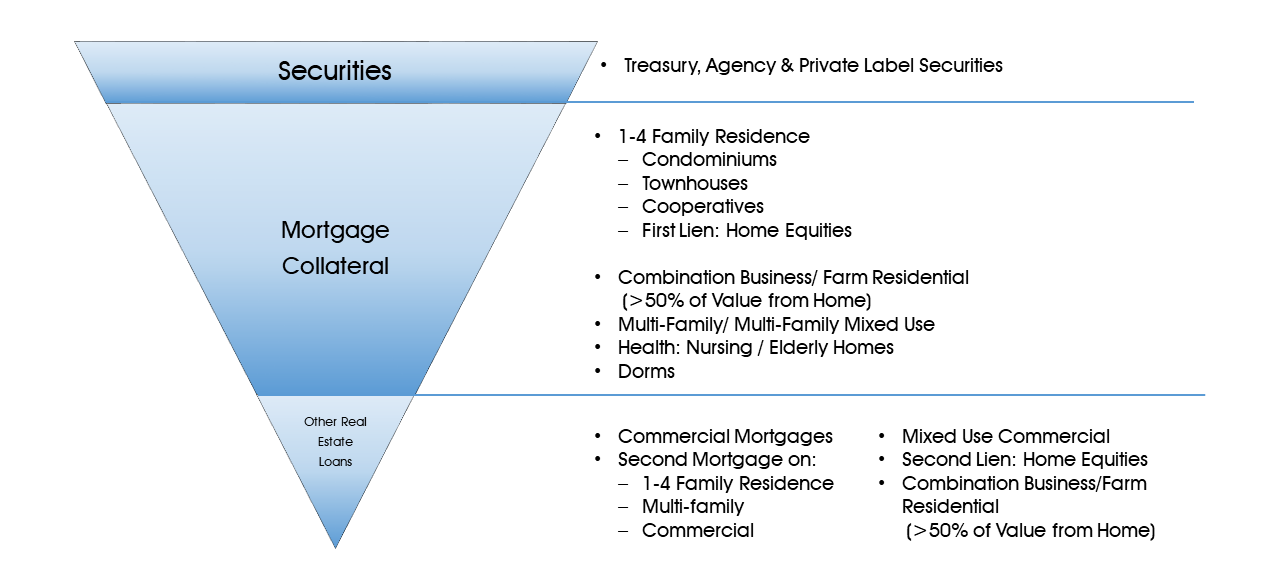

Collateral Guide Federal Home Loan Bank Of New York

How To Increase Your Borrowing Power And Get More Credit Tally

/GettyImages-1133438028-28bdfa483acd4544a110002711c2f224.jpg)

Conforming Loan Definition

/business-with-customer-after-contract-signature-of-buying-house-957745706-c107ad59288c4de0b56d10315c08c67a.jpg)

How To Improve Your Chance Of Getting A Mortgage

.jpg)

Borrowing Power Calculator How Much Can I Borrow Westpac

Direct Credit Home Loans Tailored Residentail Commercial Loans Direct Credit

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Mortgage Calculator To Discover Your Home Loan Options Instantly Online

What Can Affect Your Borrowing Power

Ai And Automation In Loan Origination And Underwriting Capacity